Don’t be passive when it comes to employee financial wellness

Effective open enrollment includes smarter, data-informed health plan selection

Many employers are expanding their wellness programs to encompass financial wellness in addition to the physical wellness and disease management programs that have become ubiquitous. These programs are often focused on retirement savings, emergency funds, and student debt support. But, benefits teams can focus closer to home and ensure employees are supported in increasing their health insurance literacy.

A recent survey showed that many Americans have low health insurance literacy, and well over half cannot define common insurance terms such as coinsurance and copayment. When combined with the fact that the majority of employers opt for passive benefits enrollment, this means that many plan members auto-enroll in the same plan year after year and may have chosen that plan from a poorly informed perspective.

One study found that the average enrollee selected a plan that was not the most financially beneficial for them, with lower-income, female, older, and chronically ill employees most likely to opt for less financially beneficial plans. Many employees choose these plans because they think they afford access to a wider provider network, but this is usually not the case.

Connect employees with the best-fit health plan

To support employee benefit choices, it is important to provide education on what the plan covers and the providers that are included. For example, a Health Savings Account (HSA) plan is the lowest cost option for most employees (approximately 3/4 of all employees who were offered the Truven Benefits Mentor tool in 2023 were estimated to have the lowest costs if they chose the HSA plan). But only about 40% of MarketScan members whose employers offered both a High Deductible Health Plan (HDHP) and a non-HDHP opted for the HDHP plan in 2022.

Financial wellness begins with health plan selection. Try Benefits Mentor

The members most likely to elect an HDHP were the younger members in the highest poverty areas, with older members and members in wealthier areas less likely to choose these plans.

When comparing industries, we see substantial variation in the percentage of members enrolled in HDHPs. For example, 66% of employees in the finance industry enrolled in HDHPs compared to 15% of services employees who elected a savings account eligible plan.

Additionally, only 9% of families who had out-of-pocket expenses at or above the IRS maximum for HDHPs in 2021 elected an HDHP for 2022, despite these plans often having lower out-of-pocket maximums than other offered plans (as this data is in aggregate, the details of the plan choices offered to each family are unavailable for analysis).

For members with high health care utilization who may be worried about large initial outlays at the beginning of the plan year, there are solutions available to help support these members in their ability to elect high-deductible plans with lower total out of pocket and premium expenses.

Open enrollment is an employee engagement opportunity

Even in a year with a passive plan enrollment, benefits teams should not be passive in communicating and educating employees. Especially in an environment where average monthly expenses increased by 9%, ensuring that employees are electing the plan that is most financially appropriate for them supports employee financial wellness.

That’s why it’s critical to provide targeted communication to increase health insurance literacy, which includes helping employees understand the basics of health insurance terminology, the potential tax advantages of HSAs, and providing a clear view of employee costs, including both paycheck contributions and likely out of pocket payments.

So, how do you address this challenge?

- Do not make the mistake of viewing open enrollment as a transaction. In fact, consider active enrollment to hit this business challenge head-on. Although there are pros and cons to both passive and active enrollment options, active enrollment supports financial wellness and planning more directly by avoiding automatic re-enrollment that can lead to poor health plan fit.

- Let employees know you care about them - message year-round to personalize the healthcare experience based on each employee’s clinical and financial circumstances.

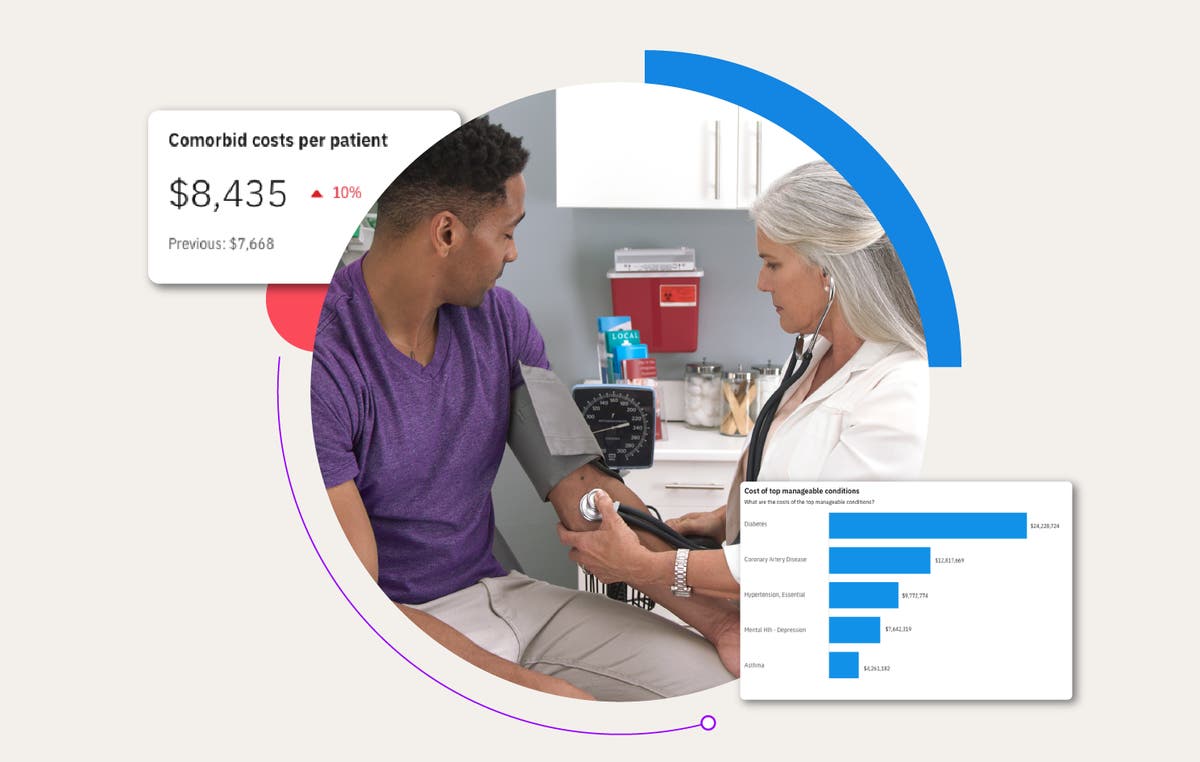

- Analyze the data. Use historical employee-specific data to remind employees of previous spend and help predict costs to select the best plan to manage their family health and household income in the year ahead.

Related Articles

How did open enrollment go in 2024? 5 tips to make 2025 more successful

Open enrollment is a critical opportunity for employers and benefits teams to...

By Merative | 4 min. read

Employee benefits and the power of personalization in the enrollment process

“So, how did it go this enrollment season?” That’s what company executives, human...

By Christine Turner | 4 min. read

How healthcare analytics help employers reduce costs and improve employee health

Year after year, employers grapple with rising healthcare costs that feel beyond...

By Jennifer Huyck | 4 min. read

Ready for a consultation?

Our team is ready to answer your questions. Let's make smarter health ecosystems, together.