Building the next generation of MarketScan: A year in review and what’s in store

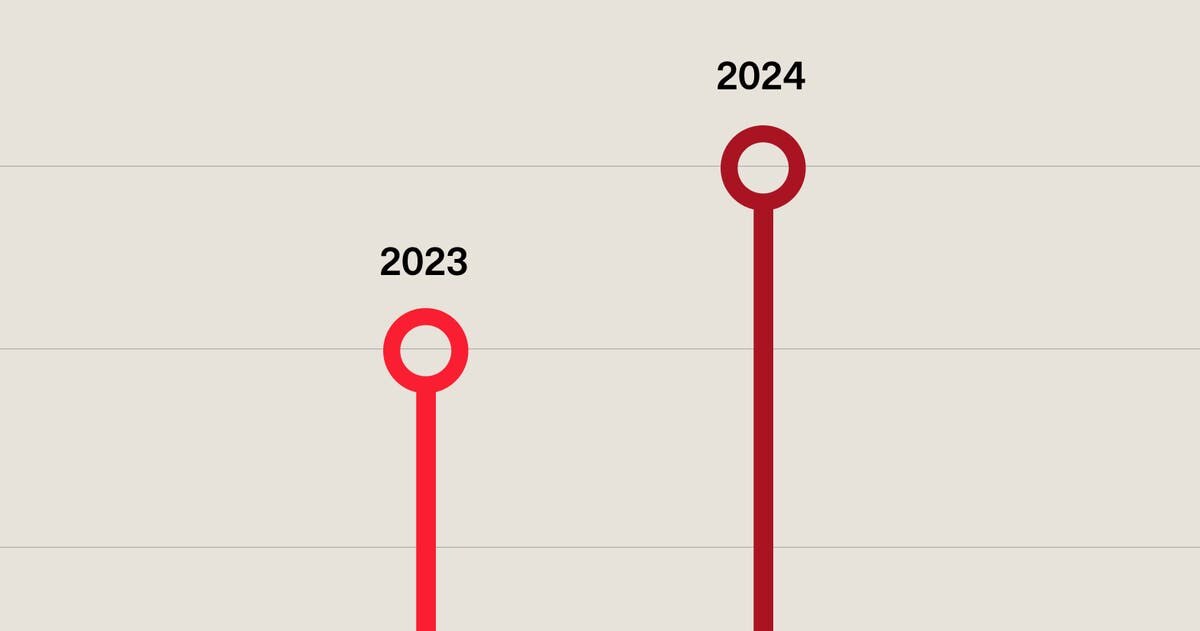

About a year and a half ago, we said goodbye to IBM Watson Health and set off on an exhilarating journey of standing up a new company, Merative™. Despite the inevitable difficulties that come with any major structural and strategic shift, our team and clients have remained steadfast; helping expand our data offerings, improve our tools and services, and form critical partnerships to make our data more accessible and versatile. This means we are entering 2024 stronger and nimbler than we have been in years.

It’s been rewarding to see our hard work pay off with the market also recognizing our growth and strategic trajectory. Most recently demonstrated with MarketScan being named a leader by IDC MarketScape and Frost & Sullivan for real-world data (RWD) and real-world evidence (RWE).

Most importantly, our MarketScan real-world data and evidence portfolio is helping research teams access stronger data with ease, resulting in better and faster insights, and ultimately driving improved patient outcomes.

Stronger data

Since becoming Merative, we’ve been able to contribute significant investments in our products and research analytics. With a renewed focus on strengthening our foundation and improving access to de-siloed healthcare data, we made critical partnerships with organizations like Datavant. These partnerships help ensure our MarketScan data is tokenized, can be linked across datasets, and remains HIPAA compliant with de-identified patient data.

2023 brought exciting new data to explore. We were able to increase our volume of lab and clinical data access, enhancing the accuracy and robustness of studies. This month, we unveiled our new MarketScan Mortality Dataset with additional mortality variables. Coupled with the unique longitudinality of our data, these mortality variables can help power studies that look at outcomes based on changes in treatment and policies. I know many are eager to get their hands on this new data, please contact us if interested.

Our Mortality Database is just one of several carefully curated datasets in our portfolio. Our core MarketScan Databases have been used by epidemiology and other researchers for over 30 years, making it the longest-running and most comprehensive closed claims dataset in the US. Similarly, our Cost Dataset is one of few available fully-adjudicated, closed claims sources that includes actual healthcare cost data with no imputation. Other curated datasets include Health and Productivity Management, helping to understand the economic impacts of individuals and families when faced with illness.

Looking ahead, I’m excited to share that we will be launching more exciting, specially curated “flavors” of data to dive into. A priority for 2024 is to provide deeper insights around social determinants of health. We need to be part of the solution to reducing the health disparity that is far too widespread in the US and across the world. I listened to a great discussion on the impact data and evidence can have on health equity and the factors to consider. I recommend watching the replay for those interested.

Faster insights

One of my top moments of the year was having a front row seat to our data becoming faster and more accessible for clients. Through our partnership with Snowflake, clients have been able to simplify their deployment process with instant access to MarketScan on the cloud, connect their favorite analytics tools, and collaborate with their data scientists in real-time. I’ve loved hearing from research teams the positive impact it’s had on their workflows, studies, and bottom line. Hear about Organon's experience in the video below:

We plan to keep the momentum going next year and will continue making our data even easier to work with. One pilot program I'm particularly excited about is looking at how we can use generative artificial intelligence (AI) applications to make our data more accessible for non-programmers.

Informed care

This year was especially exciting because we celebrated an all-time-high milestone – surpassing 4,500 peer-reviewed publications using MarketScan. I take pride in knowing how many researchers across healthcare – universities, pharma/biotech, governments, payers, and more – trust MarketScan and the value these insights bring towards transforming future care for the better.

It’s been inspiring to see organizations uncover significant findings on at-risk populations – safely and effectively. The CHU Sainte-Justine Research Center is a great example of linking data sources together to gain a more comprehensive patient-view. With these new cohorts, they’re able to safely study the associations of medications on pregnancy outcomes and help inform new regulations to protect both mothers and babies.

In 2024, RWD and RWE will become more of a focus for regulatory decision-making. Recently, the FDA published final guidance on considerations for the use of RWD and RWE to support regulatory decision-making for drug and biological products.1 The size and quality of MarketScan data is critical for reporting to regulatory bodies with precision, and MarketScan is often chosen as the preferred dataset. In addition, our Research & Analytics team has deep expertise in regulatory work and has completed many important studies in close partnership with our clients and the FDA.

I’m truly energized by what the future holds and look forward to another year of MarketScan fueling health advancements around the world. As you plan for the new year, our team is available to answer questions and brainstorm solutions.

References

-

https://www.federalregister.gov/documents/2023/08/31/2023-18841/considerations-for-the-use-of-real-world-data-and-real-world-evidence-to-support-regulatory

Related Articles

HEOR explained: Improving healthcare decisions with real-world evidence

How longitudinal closed claims data are advancing regulatory, epidemiology, and...

By Liisa Palmer | 4 min. read

Behind the posters: Exclusive insights from MarketScan researchers

Our MarketScan clients and researchers are fueled by curiosity and a passion to...

By Merative | 5 min. read

Mortality data: Driving health research forward

Learn how the MarketScan Mortality Database can help generate insights, examine...

By Liisa Palmer | 2 min. read

Ready for a consultation?

Our team is ready to answer your questions. Let's make smarter health ecosystems, together.